The Inflation Reduction Act (IRA), one of the key legislative achievements the Biden-Harris administration, aims to expand benefits and reduce costs for Medicare beneficiaries. Among its provisions, the IRA introduced a significant temporary reimbursement boost for biosimilar drugs under Medicare Part B, designed to encourage their adoption.

Biosimilars, often referred to as follow-on biologics, are drugs that are highly similar to an original biologic medicine (reference product) but are typically offered at lower prices. The IRA’s reimbursement enhancement, effective from October 2022, was introduced to incentivize the use of these cost-saving alternatives. The law increases the reimbursement rate for qualifying biosimilars to 108% of the originator product’s Average Selling Price (ASP), up from the standard 106%.

This boost comes with some conditions:

- Eligibility Tied to ASP: Only biosimilars with an ASP lower than the reference product qualify. This eligibility can fluctuate as market prices change.

- Five-Year Window: The enhanced reimbursement applies for five years from the establishment of the biosimilar’s ASP, potentially extending to 2032 for products launching in 2027.

Fast adoption of biosimilars is crucial for their commercial success, as slow uptake significantly reduces market share. This rapid uptake is particularly important in oncology, where faster adoption leads to substantial cost savings for both healthcare systems and patients. Markets with quick biosimilar uptake see significantly higher market share, averaging 75% within three years, compared to just 23% in slow uptake markets, according to data published in the Samsung Bioepis’ Biosimilar Market Report for Q1 2024.

So how has this policy impacted the biosimilars market?

We surveyed 79 facilities administering intravenous (IV) oncology therapies in order to examine respondents’ awareness of the policy and the overall impact the IRA has had on the biosimilars market. Here are our 3 key takeaways:

1. The IRA has had a small but measurable impact on the biosimilars market

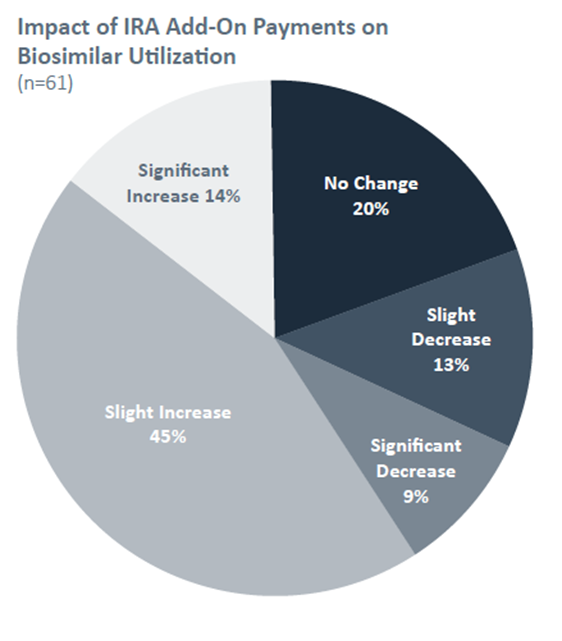

Our findings suggest that the IRA’s enhanced reimbursement has led to a modest boost in biosimilar utilization. Approximately 59% of respondents reported a slight or significant increase in biosimilar use at their facilities, which they attributed to the IRA’s incentives.

However, 20% observed no change, and some even reported a decrease, citing factors like lack of awareness and institutional inertia.

Market data analysis supports these findings, showing a small but measurable increase in the market share of biosimilars eligible for the IRA boost compared to ineligible products. However, the increase, averaging less than 1%, indicates that the impact has been limited so far.

The real test for the IRA’s biosimilar boost will come in the next few years as more biosimilars enter markets where net cost recovery is a significant revenue source, such as in bone health and ophthalmology. These markets, unlike the oncology sector, may be more resistant to biosimilar adoption due to factors like lower drug purchase volumes and the strong negotiating power providers have regarding payer policies.

2. Price and payer considerations drive biosimilar use

The overall adoption of biosimilars in the surveyed facilities is strong, with nearly all respondents using at least one of the surveyed biosimilars. The average number of biosimilars used per facility was six, with the most common reasons for their use being:

- Cost Savings: Biosimilars offer attractive net prices.

- Clinical Equivalence: Biosimilars are seen as clinically equivalent to their reference products.

- Reimbursement Policies: Managed care organizations’ policies and the IRA’s reimbursement incentives are also significant factors.

Read how Certara is helping to accelerate medicines with Biosimulation Software.

3. The modest impact of the IRA’s reimbursement enhancement may be due to pre-existing market dynamics

Interestingly, the oncology and supportive care biosimilar market already saw substantial uptake and price erosion before the IRA’s implementation, driven by competition among multiple biosimilars.

A case study of Herceptin biosimilars, for instance, highlights how a drop in ASP, driven by competitive pricing, led to increased market share for biosimilars even before the IRA’s provisions came into play. This suggests that while the IRA’s enhanced reimbursement is beneficial, it might not be the primary driver of biosimilar adoption in this already competitive market. The higher utilization may reflect the market’s maturity with the first Herceptin biosimilar (Ogivri) receiving FDA approval in 2017.

The data for Herceptin and its biosimilars reveals a strong link between the drop in average ASP and the biosimilar market share. As ASPs drop (driven by discounts given by manufacturers of biosimilars and the originator product), use increases nearly proportionally.

Learn how Certara experts can help support your complex biologic drug development program.

Conclusion: A small step forward for the biosimilars market

The IRA’s enhanced reimbursement has had a small but positive impact on the uptake of biosimilars in oncology and supportive care, contributing to cost savings in the U.S. healthcare system. However, the overall impact has been modest, partly due to the competitive dynamics already present in these markets. As more biosimilars enter new therapeutic areas, the true effect of the IRA’s provisions will become clearer. For now, it remains a promising but not transformative measure in the ongoing effort to promote biosimilar adoption.

To read more about our survey, including a detailed look at our methodology and survey sample, download the white paper: Boost or Bust? Evaluating The Impact of The IRA’s Enhanced Reimbursement on Uptake of Biosimilars